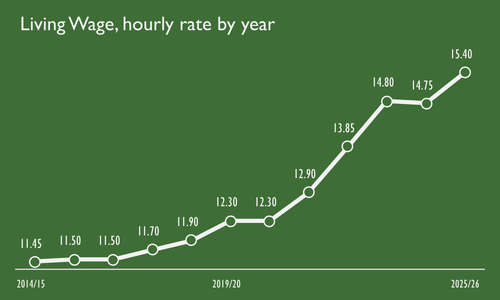

Living Wage

The Living Wage rate for 2025/26 is €15.40 per hour

The Living Wage for 2025/26 is €15.40 per hour. This is a €0.65 (4.4%) increase from the 2024/25 rate of €14.75 per hour. The new Living Wage rate is €1.90 above the current National Minimum Wage of €13.50 per hour.

This is the minimum rate required for a full-time worker (without dependents) to afford the goods and services that people have agreed are essential for enabling a life with dignity.

The Living Wage rate is calculated by researchers at the Vincentian MESL Research Centre at SVP building on the evidence from the Minimum Essential Standard of Living (MESL) work. The rate is reviewed and published by the Living Wage Technical Group. It reflects the real costs faced by employees in Ireland. The change to the annual Living Wage rate is determined by changes in living costs and income taxes.

Over the past year, minimum living costs increased by 5.8% for a working-age single adult. Rising rents contributed two thirds of the change, increasing by almost €20 per week (9.3%). Increases in food, home energy and insurance costs together account for a further fifth of the growth in the cost of living. While the cost of clothing fell partially offsetting some of the other increases.

Tax changes in the last budget, particularly the Rent Tax Credit, played an important role by increasing the net (after-tax) incomes of lower paid workers. The combined amount of income tax, USC and PRSI that would be paid by a Living Wage worker reduced from €62 per week to €52 per week, a reduction mostly driven by the Rent Tax Credit (The Living Wage calculation is based on the assumption that lower income workers rent).

Policy measures, including the Rent Tax Credit, have reduced the potential impact of rising living costs on the Living Wage rate required. Without the Rent Tax Credit, the rate needed to meet the cost of living would be €0.70 higher at €16.10 per hour. Other adjustments to the income tax and USC that would be paid by a living wage worker also contributed to limiting the rate adjustment required for 2025/26.

The Living Wage rate is based on the rationale that full-time employment will at least provide for a socially acceptable minimum standard of living for a single person without dependents. It represents the minimum required to meet physical, social and psychological needs, and enable a life with dignity.

This differs from the Government’s Living Wage which adopts a fixed threshold approach as opposed to the “basket of good” approach used by the LWTG. The Government’s living wage was due to be set at 60% of the median wage by 2026, but is now due to reach this threshold by 2029.

A Living Wage is intended to establish an hourly wage rate that should provide employees with sufficient income to achieve an agreed acceptable minimum standard of living. In that sense it is an income floor; representing a figure which allows employees afford the essentials of life. Earnings below the Living Wage suggest employees are forced to do without certain essentials so they can make ends-meet.

Further details on the Living Wage and on the methodology used to calculate the hourly Living Wage rate can be found on www.livingwage.ie